Bulgaria’s unicorn Payhawk is preparing for a major funding leap as the AI-powered spend management company explores a new raise of more than $100 million. The discussions are still early, yet sources familiar with the matter suggest the round could push Payhawk’s valuation close to $2 billion. If completed, the deal would mark another defining moment for one of Europe’s fastest-growing fintech platforms and further cement Bulgaria’s place on the global startup map.

The potential raise comes at a time when investors are becoming more selective, especially in fintech. Even so, Payhawk’s growth story continues to attract attention. In 2022, the company raised $100 million in Series B funding at a $1 billion valuation, officially becoming Bulgaria’s first unicorn. That milestone was not only symbolic for the local ecosystem but also a signal that enterprise-focused fintech from Eastern Europe could compete on a global stage.

This new capital, if secured, would likely accelerate Payhawk’s expansion across Europe while deepening its product capabilities. The company has been steadily building tools designed for businesses operating across multiple countries, currencies, and regulatory frameworks. As financial compliance becomes more complex, especially for multinational firms, platforms that simplify oversight without slowing operations are gaining traction.

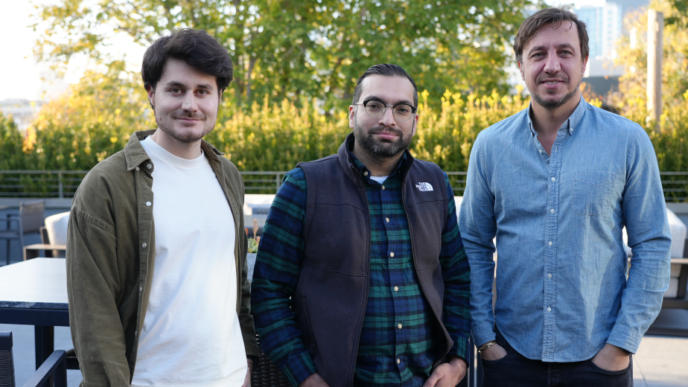

Founded in 2018 by Hristo Borisov and Boyko Karadzhov, with Konstantin Dzhengozov later joining the leadership team, Payhawk was built to unify expense management, payments, and invoice handling in one system. From the start, the focus was not on freelancers or small teams alone. Instead, the company aimed directly at mid-sized and large organizations with cross-border needs.

That positioning has shaped Payhawk’s product philosophy. The platform connects corporate cards, expense tracking, invoice processing, and supplier payments into a single workflow. It integrates tightly with accounting software and ERP systems, giving finance teams real-time visibility into spending. For companies operating in multiple markets, this reduces manual work and limits errors that often emerge from fragmented tools.

Payhawk’s client base reflects this enterprise-first approach. The company serves large SMEs and global organizations across industries that require strict control over spending. Customers such as Dott and Gaucho rely on the platform to manage high transaction volumes while maintaining compliance across regions. Rather than leaning on flashy consumer-style features, Payhawk emphasizes automation, transparency, and financial governance.

Artificial intelligence has become a central pillar of that strategy. Recently, Payhawk introduced four AI agents designed to automate core finance operations. These agents are built on an agentic AI model that allows them to execute tasks independently, not just respond to prompts. They can handle activities such as booking travel, processing payments, and managing procurement workflows.

According to the company, these AI agents can help finance teams move through processes up to 60% faster while reducing internal helpdesk queries by 40%. For chief financial officers managing complex organizations, these gains translate into faster decision-making and lower operational friction. The move signals Payhawk’s intent to embed AI directly into daily finance work rather than treating it as an add-on feature.

Investor confidence has played a major role in Payhawk’s rise. Backers such as Lightspeed Venture Partners and Greenoaks Capital have supported the company’s expansion strategy, betting on its ability to scale across tightly regulated markets. Their continued involvement suggests belief in Payhawk’s long-term vision, even as competition intensifies.

The broader spend management market in Europe has become increasingly crowded. Companies like Pleo and Spendesk have already achieved unicorn status, validating demand for modern finance tools. However, the competitive landscape is no longer limited to European players.

US-based fintechs are now making aggressive moves into the region. Brex, armed with more than $1 billion in funding and a newly secured EU license, is pushing deeper into Europe. This shift raises expectations around product depth, scalability, and capital efficiency. For European fintechs, competing at this level requires both strong fundamentals and substantial financial backing.

Against this backdrop, Payhawk’s rumored funding round stands out. It suggests that investors still see value in fintech platforms that solve everyday business problems at scale. While AI startups dominate headlines, mature fintech companies with proven revenue models and enterprise adoption continue to attract capital.

The deal, if finalized, would also highlight the resilience of Europe’s fintech sector. Despite a more cautious funding climate, companies that demonstrate consistent growth and clear differentiation are still achieving valuation step-ups. For Payhawk, the combination of AI-driven automation, enterprise focus, and regulatory expertise appears to be resonating.

As talks continue, the final size and valuation of the round could change. Yet even at this stage, the signal is clear. Payhawk is positioning itself for its next phase of growth, aiming to compete not just as a regional champion but as a serious global player in spend management. For Bulgaria’s startup ecosystem, that momentum carries symbolic weight, proving that billion-dollar fintech success can emerge far beyond