Alibaba CEO Eddie Wu is pushing back against growing worries about an AI bubble, and his message is simple. He believes the world is nowhere near one. During Alibaba’s second-quarter earnings call, Wu said the company doesn’t see much of an issue at all. Instead, he argued that demand for AI is rising far faster than the company can keep up with.

He explained that customer demand is growing so quickly that Alibaba can’t deploy servers at the speed it wants. The rise in usage, he said, is not hype. It is real adoption across industries that are now using AI to improve product development, streamline manufacturing, and support large enterprise workflows.

Wu pointed to the early momentum behind Alibaba’s Qwen app, which crossed ten million downloads in its first week. For him, that kind of traction shows how deeply AI is weaving itself into daily business activity.

Alibaba reported revenue of 247.8 billion yuan, about 34.8 billion dollars, for the quarter ending September 30. This marked a five percent increase from the previous year. But the company also felt pressure from rising AI spending. Net income dropped fifty-three percent to 20.6 billion yuan, driven by a decrease in operating income and a sharp rise in sales and marketing costs. Those expenses more than doubled as Alibaba expanded its AI footprint.

Even with that pressure, the cloud division emerged as the star of the quarter. The cloud business, which includes the Qwen platform, grew thirty-four percent to 39.8 billion yuan. Much of that growth came from public cloud revenue and the rising adoption of AI products. Wu described the momentum as a turning point that reflects how companies are shifting their operations to AI-driven tools.

Because of this, Alibaba is planning to invest far more aggressively. Earlier this year, the company revealed a three-year plan to pour 380 billion yuan into AI infrastructure. Wu now believes that number may even be too conservative. He said that in the bigger picture, the earlier commitment might be on the small side, given the wave of demand that continues to build.

Investors have responded positively. Alibaba’s stock is up more than eighty-six percent this year, showing how strongly the market is rewarding its AI-heavy strategy.

The debate over a possible AI bubble, however, continues to divide tech leaders. Wu’s stance is very different from that of Alibaba chairman Joe Tsai. Tsai warned at the HSBC Global Investment Summit that he is beginning to see early signs of a bubble, especially with the massive rush to build new data centers. He suggested that the pace of infrastructure spending could create a level of froth that resembles earlier boom-and-bust cycles.

Across the industry, the numbers are staggering. Tech giants like Microsoft, Amazon, Google, and Meta are expected to spend 320 billion dollars on capital expenditures this year alone. Much of that spending goes directly into AI infrastructure as these companies race to support the next generation of applications.

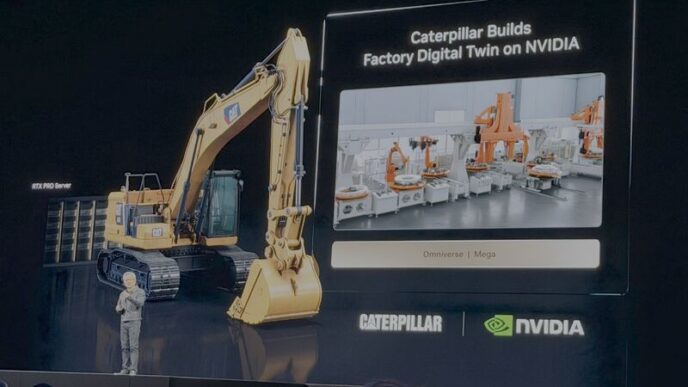

That spending boom has sparked intense debate. Some leaders reject the AI bubble narrative entirely. Nvidia CEO Jensen Huang recently said his company sees something very different from a bubble. For him, the demand is grounded in real workloads and real customers that need advanced computing power today, not years from now.

Others remain cautious. OpenAI CEO Sam Altman has said that investor excitement is ahead of reality in some areas. But he also believes that AI is still one of the most important breakthroughs in decades. His view captures the tension many people feel. There is a sense that the rush is enormous, yet the transformation underway is equally significant.

While the industry debates what is coming next, Wu is focused on scaling Alibaba’s AI capabilities as fast as possible. He believes that AI resources will stay undersupplied for the next three years. That timeline suggests that many companies will continue competing for computing power, data center capacity, and advanced chips.

Wu’s message reflects a growing view across parts of the tech world. The real risk may not be an AI bubble. It may be falling behind in a race that is moving faster than expected. As more companies adopt AI for core operations, the need for reliable infrastructure grows. That push is already reshaping the cloud market, raising capital expenditures, and forcing companies to rethink long-term strategies.

The conversation is far from over. But for now, Alibaba is making its position clear. The company is not slowing down. Instead, it is preparing for a future where AI becomes the backbone of global business. And according to Wu, that future is arriving much faster than many people believe.